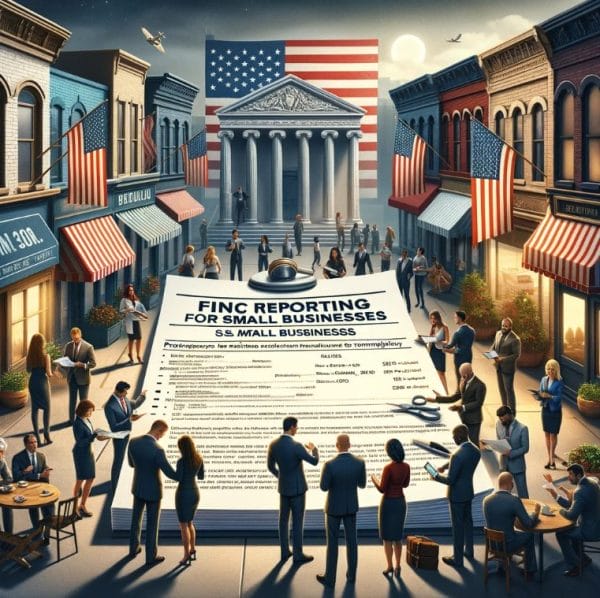

Update on Court’s Decision on the Corporate Transparency Act Explained

Breaking Down the CTA Ruling Corporate Transparency Act Update March 3rd, 2025 – And the beat goes on….and on…. Great news for business owners and accountants! The Treasury Department just dropped a game-changing announcement: No more penalties or fines for U.S. businesses under the Corporate Transparency Act’s beneficial ownership reporting rules—now or after the upcoming …