Friday News / Monday Blues

The tax world is filled with good news and bad news. Start and end your week with the latest on all things taxes!

Friday News – January 31, 2020

Kiddie Tax Now at Trust and Estate Rates

What this means: Net unearned income above the $2,200 threshold is now taxed at the trusts and estates tax rate rather than the parents’ top marginal rates.

Monday Blues – January 27, 2020

Dividends Received deduction for corporations is reduced

What this means: For corporations that own less than one-fifth of another company’s shares, the dividends received deduction is reduced from 70 to 50 percent. For corporations that own up to 80 percent of another company’s shares, the dividends received deduction is reduced from 75 to 65 percent.

Friday News – November 15, 2019

Limit on charitable contributions increased from 50% of AGI 60%

What this means: Although the limits on charitable contributions write offs are not black and white, the general 50% AGI limit has increased to 60%.

Monday Blues – November 11, 2019

New mortgage debt is limited to $750,000 for itemized deductions

What this means: Previously, the maximum amount of mortgage debt eligible for the deduction was $1 million. For mortgages starting after December 14, 2017, only mortgage debts under $750,000 will be eligible for this deduction.

Friday News – October 11, 2019

New tax credit for dependents over 16 years old

What this means: If you have dependents who are over the age of 16, you are eligible for a new $500 tax credit.

Monday Blues – July 29, 2019

Alimony Paid is no longer deductible for divorce agreements after 12/31/2018

What this means: For taxpayers whose divorce or separation agreements were finalized after December 31, 2018, their alimony payments are no longer deductible on tax returns.

Friday News – July 26, 2019

Alimony Received is no longer taxable for divorce agreements after 12/31/18

What this means: For taxpayers whose divorce/separation agreements were finalized after December 31, 2018, alimony received payments are no longer taxable and do not have to be included in their taxable income.

Monday Blues – July 22, 2019

Carryovers are maxed at 80% of taxable income for carry over years

What this means: In order to determine how much NOL will be applied to the current tax year and how much will carry forward, taxpayers are required to make certain adjustments to their taxable income. Businesses are now limited to deducting no more than 80% of their taxable income for losses arising after December 31, 2017.

Friday News – July 19, 2019

Corporate Tax Rate is now 21%

What this means: As of Jan. 1, 2018, the corporate income tax rate is now 21%, down from 35%.

Monday Blues – July 15, 2019

Moving expenses are non-deductible (except for military)

What this means: Prior to the 2018 tax year, taxpayers who relocated for a new job or transferred to a new location could deduct moving expenses from their overall tax liability. After the TCJA was passed, the moving expense deduction became available only to certain military personnel.

Friday News – July 12, 2019

Child Tax Credit doubled for tax year 2018

What this means: The Child Tax Credit has increased from $1,000 to $2,000 per child.

Monday Blues – July 8, 2019

Personal and dependent exemptions suspended

What this means: All personal and dependent exemptions have been suspended for tax years 2018-2025. Prior to the TCJA, taxpayers could claim an exemption for themselves, their spouse, and their dependents. Each exemption lowered taxable income by $4,050 under pre-TCJA law.

Friday News – July 5, 2019

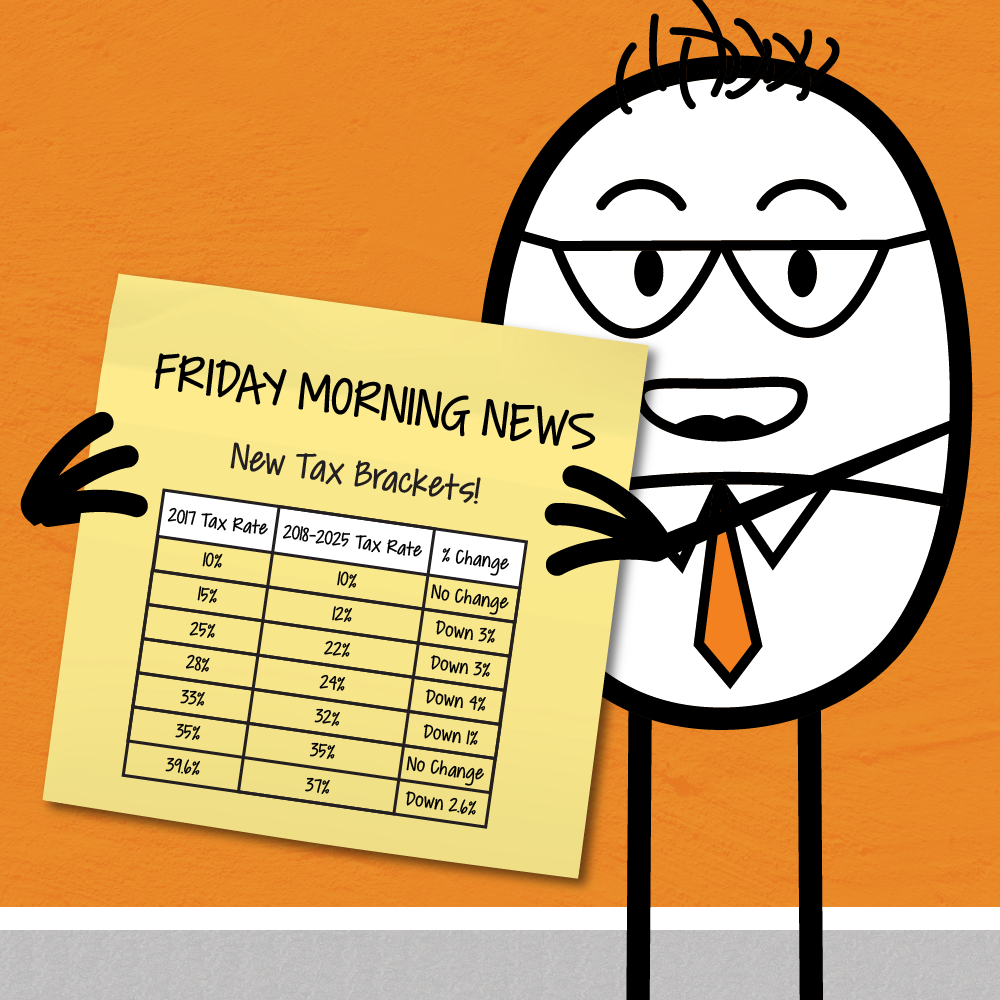

New Tax Brackets

What this means: Wider tax brackets and lower rates equals less tax paid on the same dollar amount.

Monday Blues – July 1, 2019

State and local taxes limited to $10,000 when you itemize

What this means: Whereas previously there was no limit, state and local taxes are now limited to $10,000 when you itemize your deductions.

Friday News – June 28, 2019

Overall limitation on itemized deductions has been suspended through 2025

What this means: Some taxpayers may be able to deduct more of their total itemized deductions if their deductions were limited in the past because their income was above certain levels.

Monday Blues – June 24, 2019

Miscellaneous itemized deductions (like unreimbursed business expenses) are suspended until 2025

What this means: Previously, taxpayers could deduct the amount of their miscellaneous itemized deductions that exceeded 2% of their adjusted gross income. These expenses are no longer deductible (until 2025).

Friday News – June 21, 2019

Gain exclusion for those who sold their primary residence

What this means: If you sold your primary residence in the prior tax season, you may be eligible for $500,000 of gain exclusion ($250,000 for non-joint filers).

Stay Tuned For New Posts Each Week

In the meantime, check out the rest of our posts on Tax News.