Tax Returns, CARES Stimulus & More

We are living history, folks. Stay tuned here for more updates on this fluid situation!

Dept of Treasury Paycheck Protection Program

SBA Disaster Loan Assistance Application Online

Paycheck Protection Application | Supplemental Information

Coronavirus Tax Updates

The IRS issued Notice 2020-18 on March 22, 2020, superseding Notice 2020-17. The new notice states that all taxpayers will receive an automatic extension from April 15, 2020, to July 15, 2020, without an extension needing to be filed on your behalf. All payments due on April 15 will be postponed to July 15 also. The previous $1M/$10M limit has been eliminated, this applies to all taxpayers. The deadline to contribute to an IRA, Roth IRA, or HSA for the tax year 2019 has been extended to July 15, 2020. Interest, penalties, and additions to tax with respect to this deferral will begin to accrue on July 16, 2020.

Michigan Extends April 15 Tax Deadline

Governor Whitmer signed an executive order on Friday, March 27, extending the state tax filing to align with the Federal filing date of July 15, 2020, due to the Coronavirus pandemic.

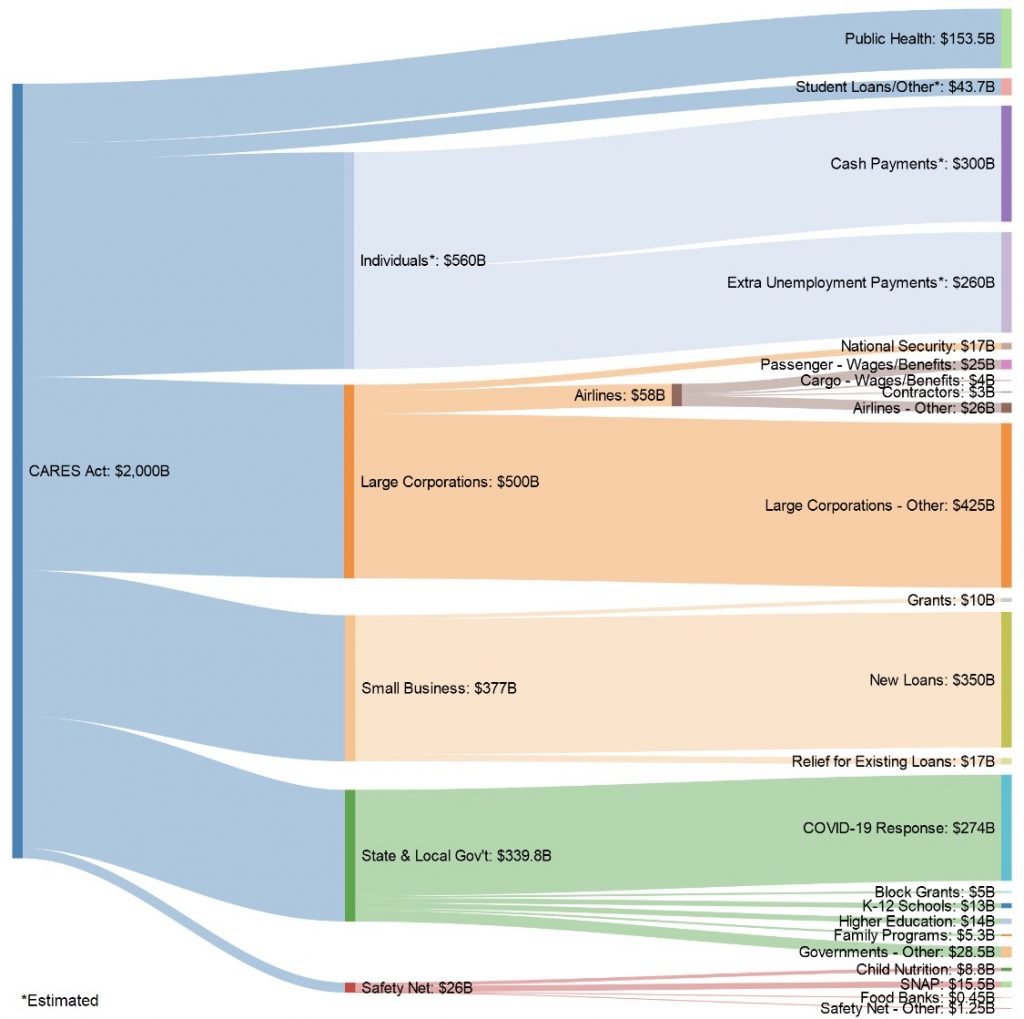

CARES Act

President Trump signed the Coronavirus Aid, Relief, and Economic Security Act (CARES) into law on March 27, 2020. This Act has $2.2 trillion in relief funds. The key provisions for our clients are outlined below:

Stimulus

“2020 recovery rebate” will be provided as an advance of a tax credit for the tax year 2020. Individuals will receive $1,200 and joint filers will receive $2,400, with an additional $500 for every child under the age of 17. This will be trued up on the 2020 tax return. The amount received will be based on the most recently filed tax return’s adjusted gross income (AGI). The phaseout range is $75K-$99K ($150K-$198K for joint filers). In order to receive the funds, individuals must not be able to be claimed as a dependent on another taxpayer’s return. Also, any money received by taxpayers based on 2018 or 2019 tax years that would otherwise be phased out by 2020 AGI will not have to be paid back.

Special Retirement Fund Usage

Waiver of 10% penalty on withdrawals of up to $100,000 from qualified retirement plans if the withdrawal occurs during the 2020 calendar year by someone who experienced adverse financial consequences as a result of COVID-19. Tax as a result of these withdrawals is eligible to be paid back over a three year period. Waiver of required minimum distributions (RMD) for 2020 as well. In addition, the 401(k) loan limit was increased from $50,000 to $100,000.

Employee Retention Credit

A fully refundable tax credit of up to 50% of wages paid up to $10,000 per employee if employers’ gross receipts declined by more than 50% or if the employer suffered a COVID-19 related shutdown order.

Federal Payroll Tax Deferment

Delay of payment of employer FICA payroll taxes from March 27, 2020, until December 31, 2020. Half of these need to be paid by December 31, 2021, with the balance due by the end of 2022.

Net Operating Loss (NOL) modifications

80% Limitation of net operating loss enacted by the TCJA goes away, with additional provisions stating any Net Operating Loss arising in 2018, 2019, or 2020 is allowed a five-year carryback of the NOL. Businesses can amend tax years dating back to 2013 to take advantage of any NOL created.

Paycheck Protection Program

Loan for eligible businesses for any payroll costs between February 15, 2020, and June 30, 2020. This loan can be for any wages, vacation pay, sick leave, state taxes, and retirement benefits paid to employees during this time period for up to an amount equivalent of $100,000 annual salary per employee. This includes self-employed individuals and independent contractors. Self-employed individuals will substantiate with documentation such as payroll tax filings, 1099-MISC, or Schedule C income and expenses, whatever is applicable. The maximum loan amount is 250% of the employer’s average monthly payroll, not to exceed $10 million. If employers maintain payroll (does not fire or lay off workers) the portion of the loans used for payroll costs, interest on mortgage obligations, rent, and utilities will be forgiven. Eligible businesses may apply for loans from any SBA-certified lender, such as banks, credit unions, or other financial institutions.

Pandemic Unemployment Assistance

The Federal bill provides $250 billion in unemployment insurance increases. The State unemployment compensation benefits to each recipient will increase by $600 per week for 4 months, extending benefits to gig workers, self-employed workers, and independent contractors. In addition, the federal government is extending these benefits for 13 weeks after the state-funded benefits end.

Student Loan Payment Deferral

All Federally-held student loans have been frozen with no additional interest accruing and no payments due until after September 30, 2020. [ UPDATE: REJOICE! As of 12/22/2021 federal student loans scheduled to be paid back starting 2/1/2022 are extended through 5/1/2022! Happy Holidays! ]

Small Business Disaster Loan Relief

The Small Business Administration (SBA) has an assistance program for Economic Injury Disaster areas providing low-interest working capital loans to small business owners affected by the Coronavirus outbreak. To be eligible for these loans, you must be a small business with 500 or fewer employees. The SBA is offering loans up to $2 million, with 2.75-3.75% interest rates. Loans must be used for rent, payroll, or accounts payable. These loans have long repayment terms to keep payments affordable. See here for more information: https://www.sba.gov/page/coronavirus-covid-19-small-business-guidance-loan-resources#section-header-0

While this act has many, many more provisions for businesses, including bailouts for the hotel, cruise ship, and airline industries, as well as providing all COVID-19 testing at no cost to Americans, we’ve identified the items above to have an immediate impact to our clients. Please reach out to your CPA Nerd to see if how the new legislation can generate cash flow to keep you afloat.

In addition to the above, mortgage lenders and landlords may have modification abilities to defer payments by extending the life of the loan. Reach out to your lenders to see if any programs exist for your business.

Coronavirus Aid, Relief, and Economic Security (CARES) Act Key Provisions

- Tax credit rebates of up to $1,200 per individual and $500 per child that is phased out for taxpayers with AGI over $75,000 ($150,000 MJF and $112,500 HOH) and will be “rapidly advanced;”

- If you haven’t filed for 2018, you get nothing. All this will be trued up when 2020 taxes are filed. Example: The government doesn’t know I have a new child if they are using the 2018 return, so I will be eligible for an additional $500 when I file the 2020 tax return next year.

- The delay of employer payroll tax deposits for 2020 (50% due by December 31, 2021, and 50% due by December 31, 2022);

- A refundable employer retention credit equal to 50% of qualified wages against quarterly employment taxes, to offset up to $10,000 of wages paid per employee in 2020;

- The reinstatement of NOL carrybacks for the 2018–2020 taxable years, and repeal of the 80% taxable income limitation for the 2018–2020 taxable years;

- A TCJA technical correction that classifies qualified improvement property as a 15-year recovery period, allowing the bonus depreciation deduction to be claimed for such property retroactive as if it was included in the TCJA at the time of enactment;

- Penalty-free withdrawals of tax retirement funds of up to $100,000 (income recognized over a three-year period);

- A temporary waiver of RMD requirements in 2020;

- The suspension of charitable contribution limits for 2020;

- The deferral of excess business loss limitations until 2021;

- An increase in the business interest deduction limitations from 30% to 50% of adjusted taxable income for the 2019 and 2020 taxable year;

- An exclusion from income for employer-payments made on employee student loans paid before January 1, 2021;

- The acceleration of the corporate credit for prior-year minimum tax liability, allowing 100% of the credit to be claimed in 2019 (2018 at the election of the taxpayer); and

- A COD exclusion of small business loans forgiven under the Act.

Thank you for your understanding as we continue to keep you informed on the coronavirus impact. For more information on taxpayers affected by the ongoing coronavirus disease pandemic, visit the IRS website.

Other Resources:

Macomb County Small Business Relief Information

Oakland County Small Business Relief Information

Wayne County Small Business Relief Information

Coronavirus (COVID-19): Small Business Guidance & Loan Resources

MI.gov Coronavirus Information

Your friendly staff at Lotito & Lazzara, P.C.,

Related Post: Corona, March Madness & Safety

One response to “Unprecedented Territory – Updated March 31st, 2020”

Posted by Barbara Matlock

Thank you so much for this information.

Posted on March 27, 2020 at 5:44 PM