Tax season can send terror through the hearts of the bravest citizens. You want your tax return to follow the law, but you also want to keep as much money as possible away from the IRS, that unpopular entity that has so much power over your finances. This process can be a bit like walking a tightrope between money in your pocket and the fiery hell of an audit. You need the latest tax information and help from tax experts.

Despite this fear, the average taxpayer can understand the basics of the tax code. For instance, learning about standard and itemized deductions is not that difficult. And you can pretty easily determine your tax bracket for 2021. Let’s get started on those things right now.

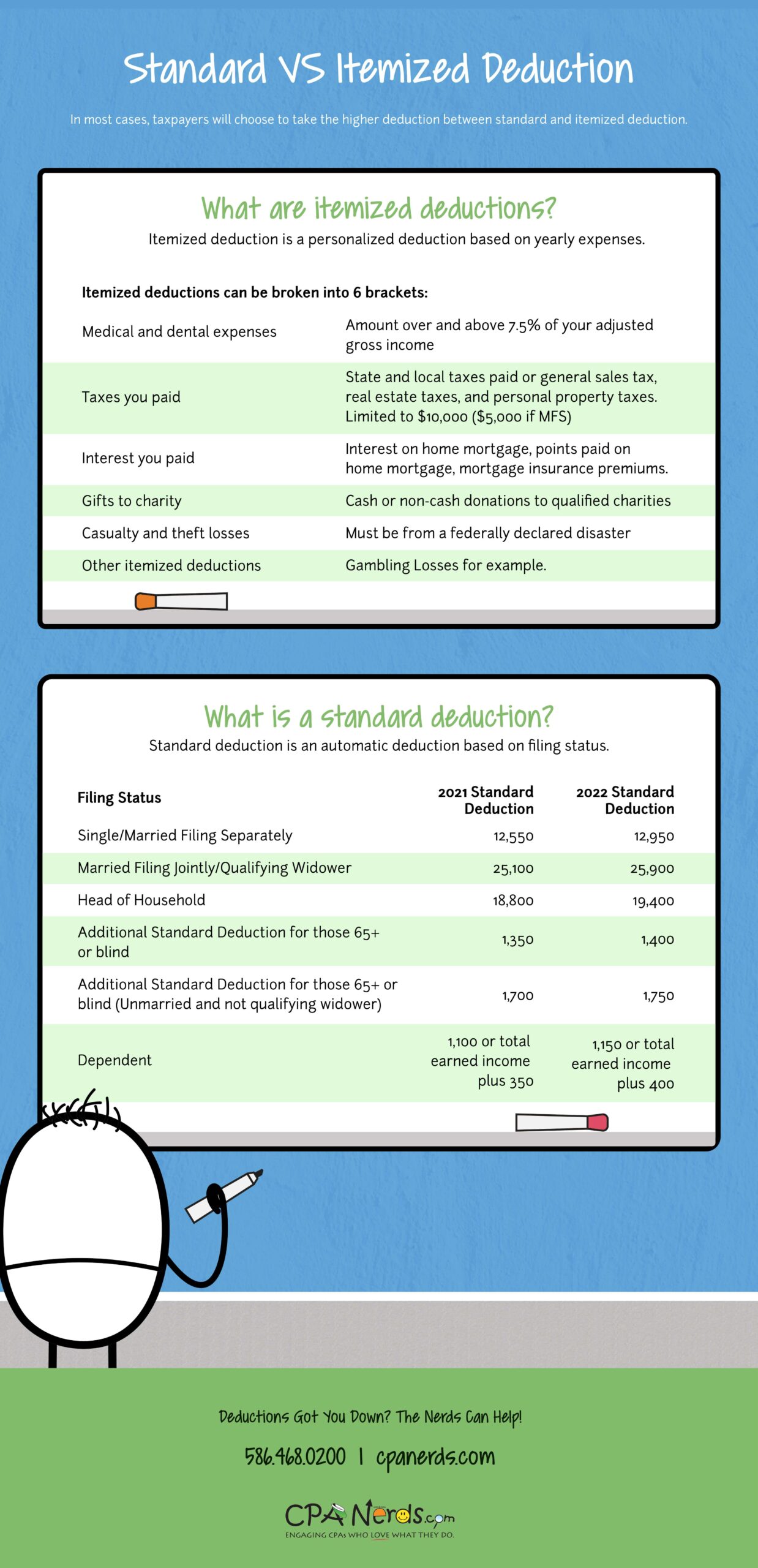

Standardized Deductions

The standard deduction is an amount that all taxpayers can automatically claim on their yearly returns to lower the amount of taxes they must pay to the government. You can subtract the standard deduction from your adjusted gross income (your gross income minus certain adjustments, such as student loan interest) to determine your taxable income. As a result, you pay significantly less in taxes.

The amount of your standard deduction differs depending on your filing status. For your 2021 taxes, a person filing as single or married filing separately is $12,550. Married couples can claim a $25,100 standard deduction. Since Congress nearly doubled the standard deduction in 2017, the percentage of households using it has reached nearly 90 percent. Claiming the standard deduction is easier than itemizing, but more importantly, most people pay less in taxes when they take the standard deduction.

Some taxpayers do still benefit by itemizing and you might be one of them. People with more complex investments, business expenses, and big mortgage payments may be better off choosing this option.

Itemized Deductions

When you itemize, you and your tax professional look for IRS-approved deductions that will reduce the amount of your taxable income by more than the standard deduction. Common itemized deductions include the following:

- Mortgage interest—This only applies to the first $750,000 of mortgage debt if you purchased your home after 2018 or $1,000,000 if you purchased your home before December of 2017.

- Charitable contributions

- Medical and dental expenses over 7.5 percent of your AGI

- State and Local Income Taxes as well as personal property tax up to $10,000

- Gambling losses

- Investment interest

The full list of itemized deductions is quite long and the IRS has implemented recent changes. To take full advantage of these deductions usually requires a tax professional—someone who reads the tax code for fun.

To help you understand standard vs itemized deductions view our info graph below.

CPA Nerds Tax Deduction Infographic

Tax Brackets

You will feel less stressed if you know what tax bracket you are actually in for 2021 taxes. You can always go directly to the IRS.gov site for this information, but in case that weirds you out, we’ll explain it here. There are seven federal income tax brackets: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Your tax bracket depends on your filing status and taxable income.

For example, single filers pay as follows:

- $9,950 and below—10 percent of taxable income

- $9,951 not exceeding $40,525—Percentage from (1) plus 12 percent of additional income over $9,950

- $40,526 not exceeding $86,375—Percentages from (1) and (2) plus 22 percent of additional income over $40,525.

- $86,376 not exceeding $164,925—Percentages from (1), (2) and (3) plus 24 percent of additional income over $86,375.

- $164,926 not exceeding $209,425—Percentages from (1), (2), (3) and (4) plus 32 percent of additional income over $164,925.

- $209,426 not exceeding $523,600—Percentages from (1), (2), (3), (4) and (5) plus 35 percent of additional income over $523,600.

- $523,601 and above (the highest tax bracket)—Percentages from (1), (2), (3), (4), (5) and (6) plus 37 percent of additional income over $523,600.

For Married Couples Filing Jointly:

- Not over $19,900—10 percent of taxable income

- $19,901 not exceeding $81,050—Percentage from (1) plus 12 percent of additional income over $19,900.

- $81,051 not exceeding $172,750—Percentages from (1) and (2) plus 22 percent of additional income over $81,050.

- $172,751 not exceeding $329,850—Percentages from (1), (2) and (3) plus 24 percent of additional income over $172,750.

- $329,851 not exceeding $418,850—Percentages from (1), (2), (3) and (4) plus 32 percent of additional income over $329,850.

- $418,851 not exceeding $628,300—Percentages from (1), (2), (3), (4) and (5) plus 35 percent of additional income over $418,850.

- $628,301 and above (the highest bracket)—Percentages from (1), (2), (3), (4), (5) and (6) plus 37 percent of additional income over $628,300.

So, say you’re a married taxpayer and your taxable income is $150,000 in 2021, your marginal tax bracket is 22 percent. However, some of your income is taxed at 10 percent and 12 percent rates.

Here’s how this looks broken down:

- The first $19,000 is taxed at 10 percent, totaling $1,990 in tax.

- The next $61,150 is taxed at 12 percent, totaling $7,338 in tax.

- Your remaining $68,950 is taxed at 22 percent, totaling $15,169 in tax.

- Total taxes assessed for $150,000 in taxable income is $24,497.

Single and Married Filing Separate is in the same tax brackets. Tax brackets change if your status is Head of Household. Keep in mind, though, that just because you “wear the pants” doesn’t necessarily make you Head of Household as far as the IRS is concerned. As you can see, even those in the highest brackets do not pay 37 percent on all of their income. The percentage is graduated as you pass through all the brackets. You only pay taxes on your taxable income and, with expert help, you can lower that figure and pay less, particularly if you choose the right deduction option.

Our tax bracket infographic goes into more detail, which you can view below.

Download The CPA Nerds Tax Bracket Infographic

The CPA Nerds Advantage

Do taxes make you uneasy? Are you looking for the right expert help? Turn to the Nerds. CPA Nerds do love the tax code and know that with any tax law change, you need to revisit your full financial roadmap. As always, planning ahead can help you maximize your family’s financial situation and position you for greater success.

If you have any questions, submit a form, shoot us an email at info@cpanerds.comor call your Nerd at (586) 468-0200 today!