Strengthening Non-Profits: Financial Audits

In the world of non-profit organizations, financial transparency and accountability are paramount. Non-Profit Expert Financial Audits and Reviews need to meet state and federal regulations, as well as to assure donors and stakeholders of their fiscal responsibility, many non-profits turn to expert accounting teams for financial preparation and audit reviews. These crucial processes not only demonstrate a commitment to good governance but also help organizations thrive and make a meaningful impact in their respective fields.

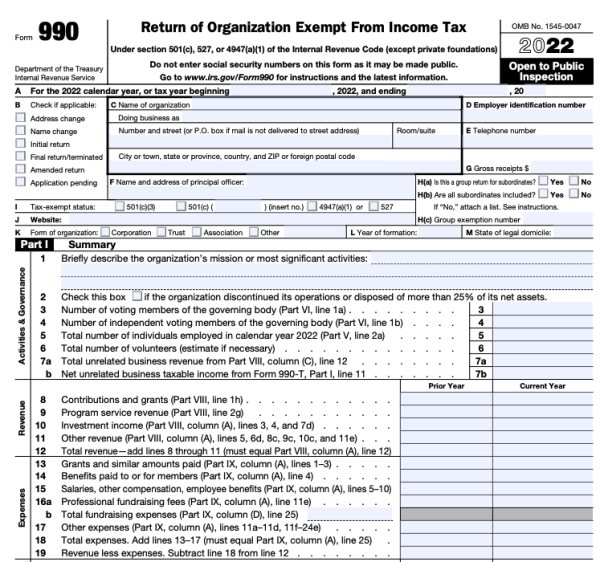

Form 990: Non-Profit Mandatory Disclosures

Form 990: Non-Profit Mandatory Disclosures

Navigating Form 990, the essential document for non-profit organizations can be a complex endeavor. One common pitfall that non-profits often stumble upon involves disclosures. Many organizations unintentionally fail to provide comprehensive and accurate disclosures, which are crucial for transparency. These disclosures encompass various aspects, such as governance, executive compensation, and program service accomplishments. Omitting or misrepresenting this information can result in compliance issues and erode trust with donors and stakeholders.

What is the Form 990 used for?

The Form 990 serves as the Internal Revenue Service’s (IRS) principal instrument for collecting data pertaining to tax-exempt organizations. Its multifaceted purpose extends beyond mere data collection; it also serves as an educational resource, imparting knowledge about tax law obligations to these organizations while encouraging adherence to compliance standards. Additionally, non-profits utilize Form 990 as a means of disseminating information about their programs to the general public, enhancing transparency and fostering a deeper understanding of their missions and activities.

For non-profit charities and tax-exempt organizations that are not mandated to undergo audits or reviews, Lotito & Lazzara’s services extend to expertly preparing IRS Form 990, in addition to handling any required state charity reporting forms. The IRS Form 990 holds significant importance, especially for 501(c)(3) public charities, serving as a crucial document to ensure compliance and transparency.

To ensure a seamless filing process and maintain credibility, non-profits should prioritize careful attention to detail when completing Form 990 to avoid these common disclosure mistakes.

The Role of Certified Public Accountants (CPAs)

For non-profit organizations requiring an audit, Certified Public Accountants (CPAs) play a pivotal role. An audit conducted by a CPA provides an Independent Accountant’s Audit Report, along with audited financial statements that include all necessary disclosures. This comprehensive examination ensures that the organization’s financial records are not only accurate but also in full compliance with regulatory standards.

In cases where a full audit is not mandatory but financial transparency is still essential, non-profits may opt for a review or compilation of their financial statements by a CPA. These financial statements, accompanied by an Independent Accountant’s Report, offer a professional assessment of the organization’s financial health and adherence to accounting principles.

Streamlined Processes for Non-Profit Expert Financial Audits and Reviews

Efficiency is key in the world of non-profit organizations, where resources must be allocated judiciously to fulfill their missions. Many expert accounting teams offer financial preparation services in conjunction with Form 990 preparation. Form 990 is a crucial document for non-profits, as it provides a comprehensive view of their financial operations and is required for tax-exempt status.

By bundling financial statement preparation and Form 990 services, non-profits can streamline their reporting processes. This not only saves time and effort but also ensures that financial data is consistently aligned with the organization’s tax reporting obligations.

Demonstrating Accountability

For non-profit organizations, accountability is more than a buzzword; it’s a fundamental pillar of trust. Donors, grantors, and stakeholders need assurance that their contributions are being used effectively and responsibly. This is where expert financial audits and reviews come into play.

An Independent Accountant’s Audit Report or Review Report not only provides an objective assessment of an organization’s financial standing but also showcases a commitment to transparency. It tells stakeholders that the organization takes its fiduciary duties seriously and is dedicated to maintaining the highest standards of financial management.

Enhancing Decision-Making

Effective financial audits and reviews do more than satisfy regulatory requirements and boost trust; they also empower non-profit organizations to make informed decisions. By scrutinizing financial records, identifying trends, and highlighting areas for improvement, CPAs offer valuable insights that can inform strategic planning.

Moreover, financial audits and reviews help organizations identify and rectify any financial irregularities or internal control weaknesses. Addressing these issues promptly not only ensures compliance but also safeguards the organization’s reputation and future sustainability.

Non-Profit Form 990 Conclusion

In the realm of non-profit organizations, financial preparation, and audit reviews are indispensable tools for ensuring fiscal responsibility, regulatory compliance, and stakeholder trust. By engaging expert accounting teams and CPAs, non-profits can navigate the complexities of financial management with confidence. Whether through independent audits, reviews, or compilations, these services provide a clear picture of an organization’s financial health, support good governance, and pave the way for continued success in fulfilling their missions.

Innes & Lazzara aren’t just your run-of-the-mill CPAs; they’re financial wizards with a 20+ year history of making audits and compliance fun! Yes, you read that right – they bring a touch of excitement to the world of numbers. With their remarkable expertise, they’ve been dazzling non-profits of all sizes throughout southeastern Michigan. So, if you thought audits couldn’t be enjoyable, think again!

Innes & Lazzara are here to make financial compliance a breeze while adding a sprinkle of fun to your non-profit journey. Let CPA Nerds join you in this financial adventure, and let the good times roll as you fulfill your mission and make an impact on the world!