Paycheck Protection Program: how much can you get?

The CARES Act of 2020 included the Paycheck Protection Program. This stimulus is to help businesses in need during the Coronavirus pandemic as many have a disruption in business. The $349 billion funded under the Small Business Administration (SBA) is intended to provide loans to businesses to guarantee eight weeks of payroll and other costs to help those businesses remain viable and allow their workers to pay their bills. The application process starts with a local or national bank online, and you need to do it ASAP.

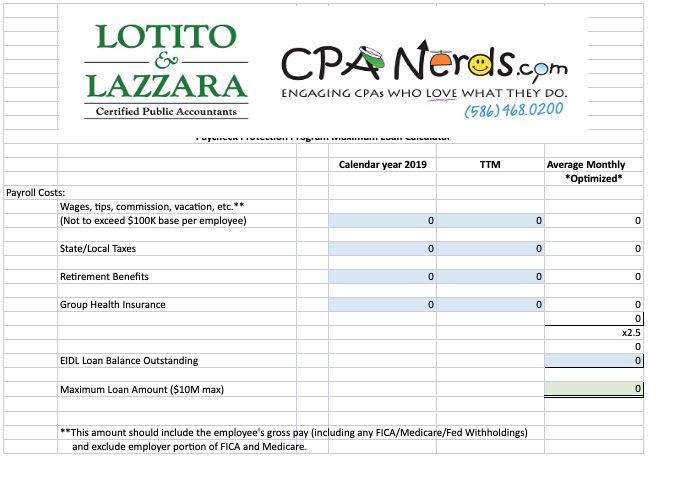

- PPP loans are available for the lesser of $10 million or 2.5 times your average monthly payroll

- 100% of your loan could be forgiven if you follow the PPP guidelines

- You can apply for both a PPP and EIDL loan

- Apply through an SBA approved 7(a), lender

Free Paycheck Protection Program Calculator

Click to Download the Paycheck Protection Program Calculator

We’ve created a simple to use PPP calculator that will help you determine what you “could” get. Click on the image above and download your copy to use. We also have a ton of other information on the tax delay and detail of the CARES ACT here.

While there are no guarantees in life (except death and taxes) we’d be willing to add one more guarantee: the Nerds commitment to help you along during these historic times. Don’t be afraid to contact us!